MARKET SUMMARY

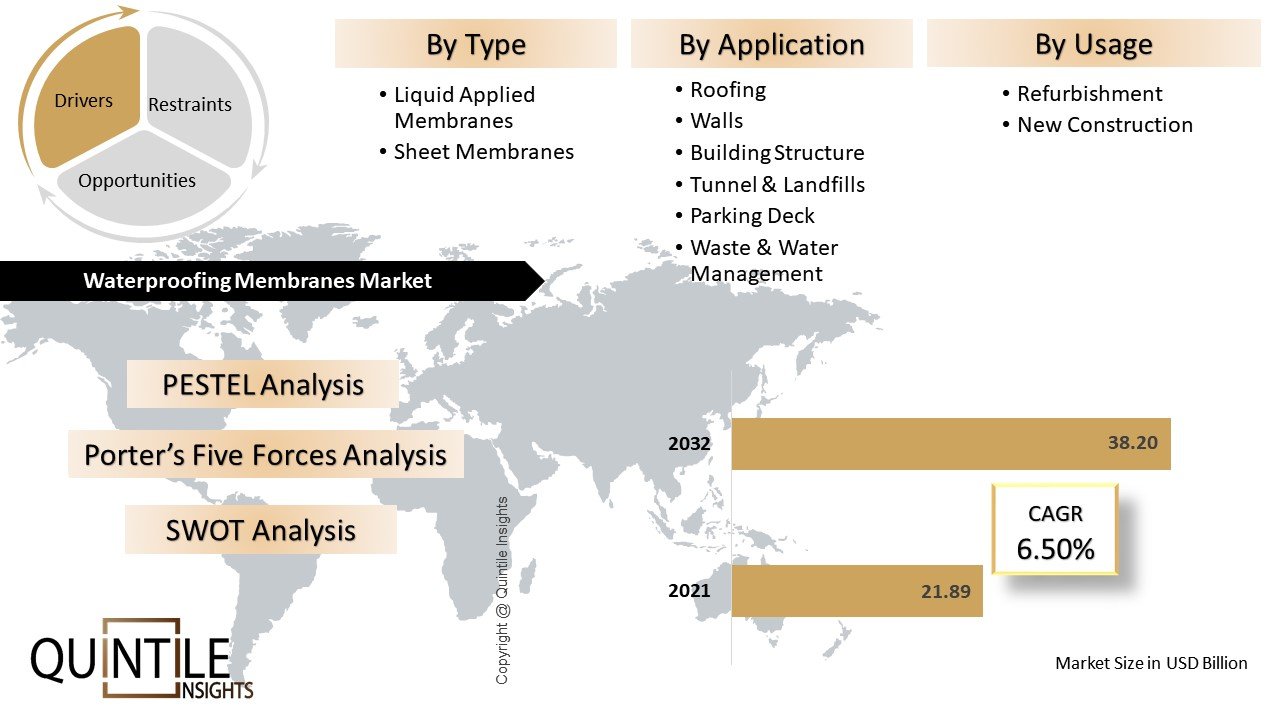

The global waterproofing membrane market was valued

at USD 21.89 billion in 2021 and it is predicted to rise at

a compound annual growth rate (CAGR) of 6.36% from 2022 to 2032. Waterproofing

membranes are utilized in wet rooms, roofs, water, sewage treatment facilities,

retaining walls, building foundations, and tunnels. The need for waterproofing

membranes is being fuelled by economic expansion, rising urbanization, and

industrialization in emerging economies, as well as increased infrastructure

investments. Product demand is expected to rise over the projection period,

thanks to increased consumer awareness of product benefits and the adoption of

new materials such as geomembranes.

A geomembrane is a synthetic membrane liner or

barrier with a very low permeability that is used with any geotechnical

engineering material to regulate fluid (liquid or gas) migration in a

human-made project, structure, or system. Geotextiles can be impregnated with

asphalt, elastomer, or polymer sprays, or as multilayered bitumen

geocomposites. Waterproofing technology is purely based on the same.

“Growing Prevalence of Infrastructure

Globally Fuels the Market”

Covid-19 has adversely affected the construction industry and its direct impacts have been felt severely on the waterproofing membrane. Following the end of the crisis, the market is expected to recover, and demand for waterproofing membranes has been predicted to rise. Demand for the infrastructure industry is expected to boom in the near future and thus booming the waterproofing market.

SEGMENT OUTLOOK:

The global waterproofing market is segmented based

on type, application, and usage.

Based on

type, the

waterproofing membrane market is segmented into liquid-applied membranes and

sheet membranes. In 2021, the liquid-applied membrane product segment dominated

the waterproofing membranes market. The increase can be ascribed to increased

awareness of the product's benefits, such as cost-effectiveness and convenience

of installation. In addition, as a global infrastructure for water conservation

and treatment improves, demand for liquid-applied membranes is likely to rise

in the future years. During the projected period, revenue for polyurethane

liquid applied membrane is expected to expand at a substantial rate of 8.8%. It

has a consistent thickness, making it convenient to use in a variety of

applications. These membranes are commonly used for roof waterproofing, moist

rooms, and water & sewage systems.

Demand for bituminous liquid membranes is estimated

to grow at a stable CAGR in terms of volume over the forecast period due to their

unique qualities such as high resistance to weathering and aging. It improves

the product's viability in terms of low-temperature flexibility, high UV

resistance, and better flow resistance at high temperatures. Due to product

characteristics such as UV radiation and precipitation resistance, polyvinyl

chloride (PVC) membrane is predicted to acquire a significant market share in

2022 and is likely to register a significant share over the forecast period.

Furthermore, the product's ability to bear big loads is projected to boost

market growth possibilities.

Based on

Application, the waterproofing membrane market is segmented

into roofing, walls, building structures, tunnel & landfills, parking decks,

and waste & water management. The roofing application category dominated

the waterproofing membranes market in 2021. The increase can be linked to its

increasing use in residential home construction in the Asia Pacific area. In

addition, the roofing segment is predicted to be driven by demand for sheet

membranes for roofs due to increased exposure to rainwater and environmental

moisture over the next seven years. The building structure is predicted to

increase at a revenue rate during the forecasted period, which may be ascribed

to its widespread use in construction to extend shelf life and defend against

extreme temperatures. In addition, the usage of sheet membrane products for

flooring applications is becoming more common.

The landfill and tunnel segment is predicted to

develop significantly during the projection period due to an increase in demand

for cleaning methods in tunnels. The growing demand for waterproofing membranes

in developing countries is likely to boost the market for waterproofing

membranes. This is due to increased industrial activity, which results in more

waste. Other areas where the waterproofing membrane is used include wet rooms,

kitchen floors, baths, and spaces around swimming pools. Furthermore, rising

awareness of long-term cost-effectiveness and risk avoidance through the

application of waterproofing membranes is likely to contribute to the market's

favorable expansion.

Based on Usage, the

waterproofing membranes market is segmented into new construction and

refurbishment. Regulations for new construction, infrastructure development,

industrialization, and urbanization in emerging economies are all contributing

to the expansion.

BY REGIONAL OUTLOOK:

On the basis of geography, the global waterproofing

membrane market is segmented into North America, Europe, Asia Pacific, Latin

America, and Middle East & Africa.

Click here to Buy Now the Report

The Asia Pacific dominated the waterproofing membranes

market in 2021. The rapid industrialization and expanding infrastructural

advancements, particularly in China and India, are to blame for the expansion.

Furthermore, the trend would create city congestion, which will boost demand

for utilities in a home application for water requirements, resulting in market

growth. During the monsoon season, countries such as Japan, Vietnam, India,

China, and Indonesia endure significant rains, necessitating the use of

waterproofing membranes on roads and structures. Furthermore, construction

activity is increasing in these countries. According to the India Brand Equity

Foundation (IBEF), the Indian government plans to build 20 million homes in

2021-22 and 23 new national highways by 2025. These operations are likely to

enhance demand for waterproofing membranes, which would help the region's

market flourish.

The waterproofing membranes market in North America

was valued at USD billion in 2021 and is predicted to grow at a substantial

rate over the forecast period, owing to increased construction activity in

Mexico and Canada. Furthermore, increased investment in warehouse development

for the healthcare and retail industries.

Product penetration in advanced countries such as

the United Kingdom, Germany, France, and others dominates product demand in

Europe. Furthermore, the growing use of waste management and water conservation

solutions that need liquid applied and sheet membranes in residential and

commercial structures is likely to boost product demand in the region throughout

the projection period. From 2022 to 2032, the demand for waterproofing

membranes in Central and South America is expected to grow at a CAGR of in

terms of volume. Furthermore, regional governments' investments in

infrastructure projects are likely to strengthen the commercial and industrial

application segment seeking waterproofing solutions, boosting market

growth.

BY KEY COMPETITORS AND MARKET SHARE ANALYSIS

The market has been characterized by integration

through the purchase of raw materials and the production of waterproofing

membranes. Companies are attempting to expand sales through mergers and

acquisitions, capacity expansion, collaborations, and other means in order to

facilitate the respective market across the globe. The waterproofing membrane

industry is dominated by a large number of players, making the market extremely

competitive. To differentiate themselves in the value chain and against

competitors, major corporations operate their businesses through a specialized

distribution network.

Sika, Tremco, BASF, Soprema, GCP applied

technologies, Fosroc, Mapei, Carlisle Construction Company, Johns Manville, and Renolit are among the prominent players. Between 2017 and 2021, these

companies used a variety of organic and inorganic expansion strategies to

expand their geographical footprint and address the rising demand for

waterproofing membranes from emerging nations.

Recent

Developments:

- In

March 2020, Sika opened a new

production plant for the SikaProof structural waterproofing membrane in

Sarnen, Switzerland. This expansion will increase manufacturing efficiency

and allow the company to serve a fast-rising market.

- In February

2020, Tremco introduced a new product called

POWERply Endure Membranes. When partnered with POWERply Endure BIO

Adhesive, these membranes can be put in a variety of hot and cold

adhesives and make extremely durable, waterproof roofs.

The

following are some of the major market players operating across the globe:

o

BASF SE

o

Kemper System America, Inc.

o

Paul Bauder GmbH & Co. KG

o

CICO Technologies Ltd.

o

Fosroc Ltd

o

GAF Materials Corporation

o

Alchimica Building Chemicals

o

Maris Polymers

o

Isomat

o

Sika AG

o

Carlisle Cos. Inc.

o

RPM International Inc.

o

GCP Applied Technologies Inc,

o

Firestone Building Products

Company

o

LLC

o

Soprema Group

o

The Dow Chemical Company

o

Pidilite Industries Ltd

|

Report Covering |

Details |

|

Market size value in 2021 |

USD 21.89 billion |

|

Revenue forecast in 2032 |

USD 38.20 billion |

|

Growth rate |

CAGR of 6.36% from 2022 to 2032 |

|

Base year for estimation |

2021 |

|

Historical data |

2017 - 2020 |

|

Forecast period |

2022 - 2032 |

|

Quantitative units |

Revenue in USD million/billion and

CAGR from 2022 to 2032 |

|

Report Coverage |

Market dynamics such as Drivers, Restraints, Market Trends and Opportunities, Revenue size, market share, company ranking, competitive landscape,

geographical presence, recent developments, strategic initiatives, and

overall contribution to the market. |

|

Segments Covered |

Type, Application, Usage, and Region |

|

Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country Scope |

U.S.; Canada; Germany; France; U.K.;

Italy; Spain; China; Japan; India; South Korea; Mexico; Brazil; Argentina;

Colombia; Saudi Arabia; UAE; South Africa |

|

Key companies profiled |

BASF SE; Kemper System America, Inc.;

GAF Materials Corporation; Paul Bauder GmbH & Co. KG; CICO Technologies

Ltd.; Fosroc Ltd.; Dupont ; Sika AG; Carlisle Cos. Inc.; RPM International

Inc.; GCP Applied Technologies Inc; Firestone Building Products Company; LLC;

Soprema Group; The Dow Chemical Company; Pidilite

Industries Ltd |

|

Customization scope |

We also provide customized reports

and If the information you seek is not included in the current scope of the

study, kindly share your specific requirements (any category, subcategory,

company profile, region, etc.), we can have a feasibility check and we could

incorporate the same as a part of report customization at no additional cost. |

|

Pricing and purchase options |

Avail of customized purchase options

to meet your exact research needs. Explore purchase options click to buy or

write us at sales@quintileinsights.com |

Click to check the detailed Table of Contents

SEGMENTS COVERED IN THE REPORT ARE AS FOLLOWS:

This report projected the revenue growth at the

global, regional, and country levels and provides an analysis of the latest

industry trends and opportunities in each of the sub-segments from 2017 to 2032.

For this study, Quintile Insights has segmented the global waterproofing membrane

market report based on type, application, and region:

By Type Insights:

Revenue in USD Million (2017 - 2032)

- Liquid Applied Membranes

§ Cementitious

§ Bituminous

§ Polyurethane

§ Acrylic

§ Other

- Sheet Membranes

§ Bituminous

§ Polyvinyl Chloride (PVC)

§ Ethylene Propylene Diene Monomer (EPDM)

§ Other

By Application:

Revenue in USD Million (2017 - 2032)

- Roofing

- Walls

- Building Structure

- Tunnel & Landfills

- Parking Deck

- Waste & Water Management

By Usage: Revenue in

USD Million (2017 - 2032)

- Refurbishment

- New Construction

Regional Insights:

Revenue in USD Million (2017 - 2032)

- North America (U.S.,

Canada)

- Europe (U.K., Germany,

France, Italy, and Spain)

- Asia Pacific (Japan,

China, India, Australia, South Korea, and Singapore)

- Latin America (Brazil,

Mexico, Argentina, and Colombia)

- Middle East & Africa

(Saudi Arabia, UAE, and South Africa)