MARKET SUMMARY

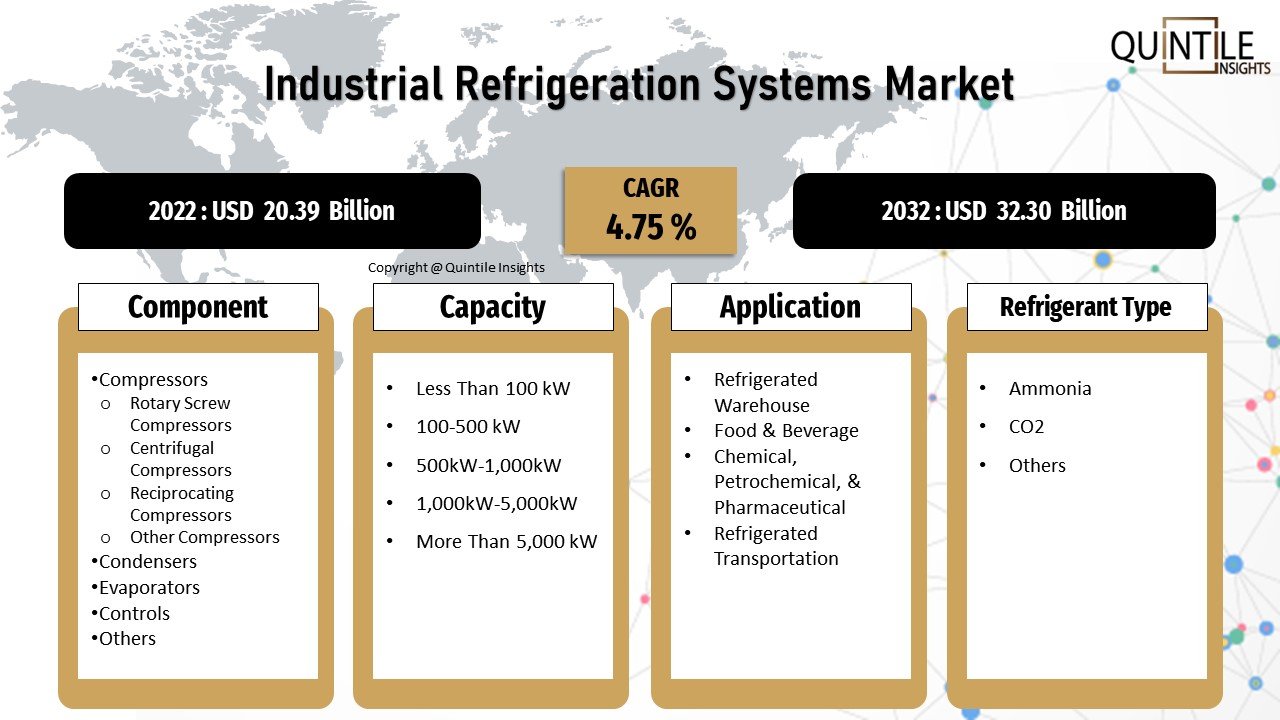

The global

industrial refrigeration systems market was valued at USD 20.39 Billion in 2022 and it is

predicted to rise at a compound annual growth rate (CAGR) of 4.75 % from 2023 to 2032. The use

of packaged, processed foods and beverages along with the requirement to stop

spoiling are driving up demand for industrial refrigeration systems on a global

scale. Global warming worries have compelled businesses to prioritize natural

refrigerants over hazardous coolants. Due to the low cost of production and

environmental neutrality of natural refrigerants, the market for real

refrigerant-based equipment has recently outgrown itself. The global adoption

of upgraded and improved cold chain systems is anticipated to have an impact on

the market during the projected period.

When temperature control of the

materials is necessary, industrial refrigeration systems is used in a variety

of end-use sectors, including the processing of food and beverages, chemical

processing, and cold storage applications. Such goods are in high demand for

HVAC, beverage production, process cooling, and food processing.

“Increasing Use of Packaged

Foods Globally Fuels the Market”

Industrial operations have been impacted by the pandemic's onset as manufacturing hubs have stopped due to lockdowns and quarantines enacted by governments around the world. However, because to the requirement for massive quantities of vaccinations to be preserved globally to combat the pandemic's scope, the market saw a demand for its products. The Centers for Disease Control and Prevention (CDC) in the United States advise using pharmaceutical or freezers or refrigerators that are especially made for storing vaccinations. The recommended storage temperatures for vaccinations were 2°C to 8°C for refrigerators and -50°C to -15°C for freezers. As a result, the market was kept alive by the necessity to store and distribute effective medicines and vaccines.

To learn

more about this report, request

a free sample copy

SEGMENT OUTLOOK:

The global industrial

refrigeration systems market is segmented based on Component, Capacity, Application,

and Refrigerant Type

Based on Components, the industrial

refrigeration systems market is segmented into compressors, condensers, evaporators, controls, and others. Due to

its major characteristics, including pressure building, use control, and

financial capability, the compressor industry is anticipated to see the

quickest CAGR between 2023 and 2032. Compressors offer a reliable and effective

driving power for more streamlined manufacturing operations. Centrifugal,

reciprocating, rotatory screws, and other types of compressors can be used to

identify them from one another. Reciprocal compressors had a significant impact

on the market in terms of revenue share in 2022. Its advantages, including high-pressure ranges of up to 30000 PSI, energy efficiency, and the availability of

oil-free and oil-flooded variations, are the key drivers of its expansion.

According

to projections, the compressor category will continue to hold the majority of

the market share, just as it did in 2022. The compressor market is expanding as

a result of factors like industrialization, automation, and a rise in the

demand for oil-free compressors in the HVAC sector due to environmental

concerns. The evaporators market is predicted to expand significantly over the

next several years as a result of the growing demand for more dependable and

energy-efficient systems. Evaporators must boost cooling by soaking up extra

heat for a refrigerator to operate at its best.

Based on Capacity, the global industrial refrigeration systems is segmented into less than 100 kW, 100-500 kW,

500kW-1,000kW, 1,000kW-5,000kW, and more than 5,000 kW. In 2022, the 500kW-1000kW capacity segment had the

largest revenue share across the globe. As it is used to store and process

processed and perishable commodities, the cooling capacity is of vital

importance in the food and beverage business. In order to extend shelf life and

reduce product waste, the dairy industry need this quality. The ideal

temperature range to prevent resource loss and food spoiling is 500kW to

1000kW.

Over the course of the projected period, a considerable

rate of growth is anticipated for the 1,000kW-5,000kW segment. The need for

storing petrochemicals, vaccines, and other products that can spoil in

unmanaged conditions is on the rise, which is the cause of this development.

High-scale power plants' internal infrastructure has a temperature range of 50

to 100 degrees Celsius. The demand for refrigeration systems with capacities

between 1,000kW and 5,000kW is expected to increase in the future since they

mitigate the effects of high temperatures on shop floors.

Click here to

get the Best

Discounted Price

Based on Application, the food and beverage segment had a

sizable portion of the market in 2022, and it is anticipated that it would

continue to rule the market during the forecast period. The key element

influencing the segment's growth is the increase in demand for packaged and

frozen food around the globe. Due to the growing urban population and their

need for packaged food, beverages, and frozen food, it is projected that refrigerated transportation and warehouse will outgrow their capacity. The

pandemic has also raised awareness about how people live their lives all across

the world. As a result, there is a greater demand for drugs and vaccinations,

which has led to an increase in the demand for transportation and refrigerated

storage facilities.

Over the projected period of 2023 to 2032,

the petrochemical, pharmaceutical, and chemical category is anticipated to

register significant growth. This growth rate is brought on by an increase in

demand for freeze-drying techniques, medical device sterilization, action heat

removal, etc. To regulate the temperatures of petrochemicals, agrochemicals,

and organic and inorganic compounds, chemical firms use cutting-edge cooling

systems. Additionally, the pharmaceutical business relies on refrigeration

techniques to store and maintain the composition of raw materials and finished

goods like bioengineered drugs and vaccines. These elements are important

drivers behind the use of industrial refrigeration systems.

On the basis of Refrigerant Type, the global market is divided into

ammonia, CO2, and others. During the anticipated period, ammonia-based

refrigeration systems held the largest market share for industrial

refrigeration systems. Ammonia-based refrigeration systems are more

energy-efficient than those based on other refrigerants because it has a

greater cooling capacity than other refrigerants. Additionally, businesses are

concentrating on producing ammonia-compatible industrial refrigeration

equipment because HCFC-based refrigeration systems will no longer be produced

after January 1, 2020.

REGIONAL OUTLOOK:

Based on geography, the industrial

refrigeration systems market is segmented into

·

North America

·

Europe

·

Asia Pacific

·

Latin America

·

Middle East & Africa

Click

here to Buy Now the Report

North America has

dominated the global market and this region is anticipated to continue growing

steadily during the projection period. The growth of e-commerce is the primary

element influencing the market's development. Because buying groceries online

has become a part of daily life, e-commerce has changed how consumers behave

when making purchases. Additionally, retailers are required to keep perishables

at the HACCP-mandated standard temperatures, which raises the demand for

suitable refrigerated storage systems. The market is expanding as a result of

clinical trials and research focused at containing the COVID-19 pandemic in

North America.

The Asia

Pacific region is anticipated to experience the greatest

growth. It is related to the rise in cold storage infrastructure requirements

in China, Japan, and India. The top producer of fruits and vegetables worldwide

is China, followed by India. Harvests from China and India are sent to other

nations worldwide. To increase cold storage management and enhance

refrigeration and refrigerated warehouse management in their different

countries, separate governments have undertaken a number of programs.

BY

KEY COMPETITORS AND MARKET SHARE ANALYSIS:

As a result, leading firms are

focused on maintaining long-term operations and developing manufacturing and

distribution capabilities to increase their market position. The competition

among the players is based on numerous parameters including quality,

innovation, product offerings, price, and, corporate reputation.

Recent

Developments:

·

Launched in November 2020, the

Güntner Cubic VARIO Air Cooler by Güntner GmbH & Co. KG promises to kill

over 99% of airborne germs in just a few hours.

·

Daikin Industries, Ltd. stated

in November 2018 that it had acquired the Austrian company AHT Group, which makes

exhibits for refrigeration and freezing. Daikin Industries Ltd. will be able to

provide full coordination of refrigeration and air conditioning products thanks

to the buyout, which will enable AHT group's showcases to be included in their

line of products based on their refrigeration and air conditioning equipment.

The

following are some of the major market players operating across the globe:

·

Johnson Controls

·

Emerson Electric Co.

·

Danfoss

·

GEA Group Aktiengesellschaft

·

MAYEKAWA MFG. CO., LTD.

·

BITZER Kühlmaschinenbau GmbH

·

DAIKIN INDUSTRIES, Ltd.

·

EVAPCO, Inc.

·

Güntner GmbH & Co. KG

· LU-VE S.p.A.

Report Covering | Details |

Market size value in 2022 | USD 20.39 Billion |

Revenue forecast in 2032 | USD 32.20 Billion |

Growth rate | CAGR of 4.75 % from 2023 to 2032 |

Base year for estimation | 2022 |

Historical data | 2017 - 2020 |

Forecast period | 2023 - 2032 |

Quantitative units | Revenue in USD Billion and CAGR from 2023 to 2032 |

Report coverage | Market dynamics such as Drivers, Restraints, Market Trends and Opportunities, Revenue size, market share, company ranking, competitive landscape, geographical presence, recent developments, strategic initiatives, and overall contribution to the market. |

Segments covered | Component, Capacity, Application, Refrigerant Type, Region |

Regional scope | North America; Europe; Latin America; Middle East & Africa; Asia Pacific. |

Country Scope | U.S.; Canada; Germany; France; U.K.; Italy; Spain; China; Japan; India; South Korea; Mexico; Brazil; Argentina; Colombia; Saudi Arabia; UAE; South Africa |

Key companies profiled | Johnson Controls; Emerson Electric Co.; Danfoss; GEA Group Aktiengesellschaft; MAYEKAWA MFG. CO., LTD.; BITZER Kühlmaschinenbau GmbH; DAIKIN INDUSTRIES, Ltd.; EVAPCO, Inc.; Güntner GmbH & Co. KG |

Customization scope | We also provide customized reports and If the information you seek is not included in the current scope of the study, kindly share your specific requirements (any category, subcategory, company profile, region, etc.), and we can have a feasibility check and we could incorporate the same as a part of report customization at no additional cost. |

Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options click to buy or write us at sales@quintileinsights.com |

Click here to Ask for Customization In the Report Scope

SEGMENTS COVERED IN THE REPORT ARE AS FOLLOWS:

This report

projects revenue growth at the global, regional, and country levels and

provides an analysis of the latest industry trends and opportunities in each of

the sub-segments from 2017 to 2032. For this study, Quintile Insights has

segmented the global industrial refrigeration systems market report based on

components, capacity, application, and region:

By Components Insights: Revenue in USD Million

(2017 - 2032)

·

Compressors

~ Rotary Screw Compressors

~ Centrifugal Compressors

~ Reciprocating Compressors

~ Other Compressors

·

Condensers

·

Evaporators

·

Controls

·

Others

By Capacity Insights: Revenue in USD Million

(2017 - 2032)

·

Less Than 100 kW

·

100-500 kW

·

500kW-1,000kW

·

1,000kW-5,000kW

·

More Than 5,000 kW

By Application Insights: Revenue in USD Million

(2017 - 2032)

·

Refrigerated Warehouse

·

Food & Beverage

·

Chemical, Petrochemical, &

Pharmaceutical

·

Refrigerated Transportation

By Refrigerant Type Insights: Revenue in USD

Million (2017 - 2032)

·

Ammonia

·

CO2

·

Others

Regional Insights: Revenue in USD Million (2017 -

2032)

·

North America (U.S., Canada)

·

Europe (U.K., Germany, France, Italy, and

Spain)

·

Asia Pacific (Japan, China, India, Australia,

South Korea, and Singapore)

·

Latin America (Brazil, Mexico, Argentina,

and Colombia)

·

Middle East & Africa (Saudi Arabia, UAE,

and South Africa)